The Ecu Routing Number Longview Tx is essential for various financial transactions, and CAR-DIAGNOSTIC-TOOL.EDU.VN provides comprehensive resources for automotive professionals, including diagnostic tools and repair guidance. Understanding the significance of this number and similar identifiers will help you streamline your business operations. We also offer remote support and specialized training programs to enhance your skills.

Contents

- How CAR-DIAGNOSTIC-TOOL.EDU.VN Can Help You

- Benefits of Choosing CAR-DIAGNOSTIC-TOOL.EDU.VN

- Success Stories

- Take the Next Step

- Addressing the Challenges of Automotive Technicians

- How Our Services Address Your Needs

- FAQ: ECU Routing Number and Automotive Diagnostics

- AIDA: Attract, Interest, Desire, Action

- Attention

- Interest

- Desire

- Action

1. What is an ECU Routing Number Longview TX?

An ECU (Electronic Control Unit) routing number in Longview, TX, doesn’t exist because ECUs are components within vehicles and not related to financial institutions. A routing number, also known as an ABA routing number, is a nine-digit code that identifies a financial institution in a transaction. These numbers are used by Federal Reserve Banks to process Fedwire funds transfers, ACH (Automated Clearing House) direct deposits, bill payments, and other automated transfers. According to the American Bankers Association, every bank in the United States has at least one routing number.

2. How Does a Routing Number Work?

Routing numbers facilitate the electronic transfer of funds between banks. They ensure that money is sent to the correct financial institution. The Federal Reserve System uses these numbers to process payments, direct deposits, and other electronic transfers efficiently. Understanding routing numbers can significantly reduce errors and delays in financial transactions.

3. Why is the Correct Routing Number Important?

Using the correct routing number ensures that your financial transactions are processed smoothly and accurately. An incorrect routing number can lead to delays, returned payments, or even misdirected funds. For businesses, accuracy in financial transactions is vital for maintaining good relationships with suppliers and ensuring timely payments.

4. Where Can You Find a Bank’s Routing Number?

You can find a bank’s routing number in several places:

- Bank’s Website: Most banks list their routing numbers on their official websites.

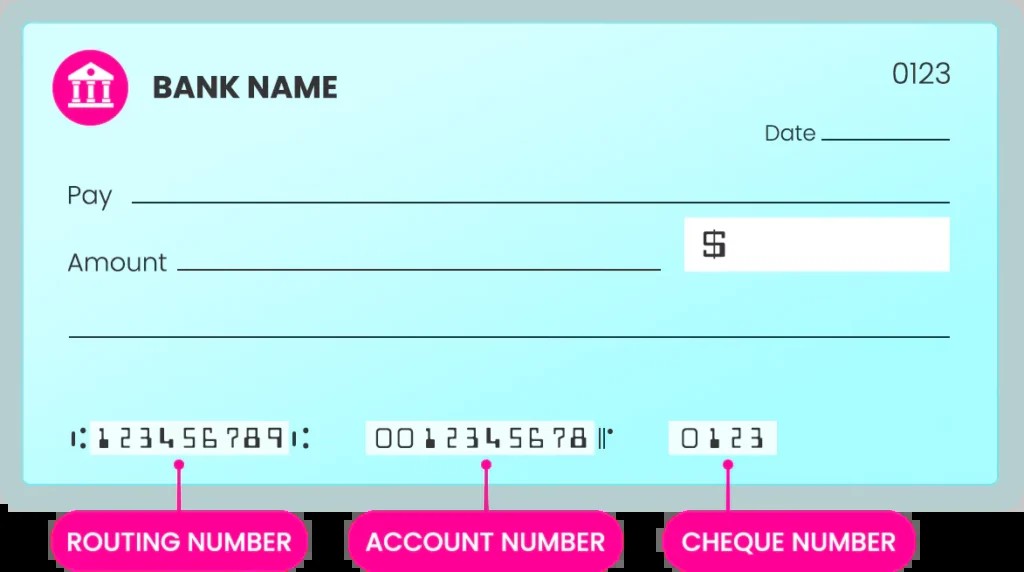

- Check: The routing number is usually printed on the bottom left corner of your checks.

- Bank Statement: Your bank statement typically includes the routing number.

- Directly from the Bank: You can call or visit your bank to obtain the routing number.

- Federal Reserve Website: The official Fedwire website also provides a tool to look up routing numbers.

5. What is the Difference Between a Routing Number and an Account Number?

A routing number identifies the bank, while an account number identifies the specific account at that bank. The routing number ensures that the funds reach the correct financial institution, and the account number specifies which account within that institution should receive the money. Both are essential for completing financial transactions accurately.

6. Can a Bank Have Multiple Routing Numbers?

Yes, a bank can have multiple routing numbers, especially if it operates in multiple states or has different routing numbers for different types of transactions. For instance, some banks have separate routing numbers for wire transfers and ACH transactions. Always verify you are using the correct routing number for the specific type of transaction you are conducting.

7. What is a SWIFT Code?

A SWIFT (Society for Worldwide Interbank Financial Telecommunication) code, also known as a BIC (Bank Identifier Code), is used for international wire transfers. While routing numbers are used for domestic transfers within the US, SWIFT codes are necessary for identifying banks in international transactions. The SWIFT code ensures that the international wire transfer reaches the correct bank.

8. How Do I Find a SWIFT Code?

You can find a SWIFT code in the following ways:

- Bank’s Website: Banks often list their SWIFT codes on their websites, usually in the international wire transfer section.

- Bank Statement: Some bank statements include the SWIFT code.

- Directly from the Bank: You can call or visit your bank to ask for the SWIFT code.

- SWIFT Code Lookup Tools: Several online tools can help you find the SWIFT code by entering the bank name and country.

9. Why is a SWIFT Code Needed for International Transfers?

A SWIFT code is needed for international transfers because it provides a standardized way to identify banks globally. This ensures that money is routed correctly between different countries, reducing the risk of errors and delays. Without a SWIFT code, international wire transfers can be significantly more difficult and prone to mistakes.

10. What Types of Transactions Require a Routing Number?

Routing numbers are required for various types of transactions, including:

- Direct Deposits: Setting up direct deposit for your paycheck or government benefits.

- ACH Payments: Making or receiving payments through the Automated Clearing House network.

- Wire Transfers: Sending or receiving money via wire transfer.

- Online Bill Payments: Paying bills online through your bank’s website or app.

- Electronic Checks: Processing payments using electronic checks.

11. How Can I Verify a Routing Number?

You can verify a routing number by:

- Contacting the Bank: Call the bank directly to confirm the routing number.

- Using the Federal Reserve’s Website: Check the official Fedwire website to verify the routing number.

- Referring to Official Bank Documents: Review checks or bank statements to ensure the routing number matches.

12. What Happens if I Use the Wrong Routing Number?

If you use the wrong routing number, the transaction may be delayed, returned, or sent to the wrong bank. In some cases, the funds may be lost, and it could take time to recover them. Always double-check the routing number before initiating a transaction to avoid these issues.

13. Is the Routing Number the Same as the Sort Code?

No, the routing number is not the same as the sort code. The routing number is used in the United States, while the sort code is used in the United Kingdom and some other countries. Both serve a similar purpose—identifying the financial institution—but they are used in different regions.

14. How Does ACH Use Routing Numbers?

ACH (Automated Clearing House) uses routing numbers to process electronic payments and transfers between banks. When you set up a direct deposit or an online bill payment, you are using the ACH system, which relies on routing numbers to direct the funds to the correct bank. According to NACHA (National Automated Clearing House Association), the ACH network processes trillions of dollars in transactions each year.

15. How Do Wire Transfers Use Routing Numbers?

Wire transfers use routing numbers to identify the bank receiving the funds. For domestic wire transfers, the routing number is essential for directing the money to the correct financial institution. For international wire transfers, a SWIFT code is also required to ensure the money is routed correctly across borders.

16. What Security Measures Are in Place to Protect Routing Numbers?

Banks implement various security measures to protect routing numbers, including encryption, secure servers, and fraud detection systems. Additionally, regulatory bodies like the FDIC (Federal Deposit Insurance Corporation) oversee banking practices to ensure the safety and security of financial transactions. Customers also play a role by protecting their account information and reporting any suspicious activity.

17. Can I Use a Routing Number to Find Out Who Owns an Account?

No, you cannot use a routing number to find out who owns an account. Routing numbers only identify the bank and branch; they do not provide any information about the account holder. Account information is private and protected by banking regulations.

18. How Do I Set Up Direct Deposit Using a Routing Number?

To set up direct deposit, you will need to provide your employer or the organization initiating the payment with your bank’s routing number and your account number. You may also need to provide a voided check. This information allows the payer to electronically deposit funds directly into your account.

19. What is the Difference Between a Wire Transfer and an ACH Transfer?

A wire transfer is a direct transfer of funds from one bank account to another, typically used for larger amounts and processed quickly. An ACH transfer is an electronic transfer between banks, often used for recurring payments and direct deposits, and typically takes one to three business days to process. Wire transfers are generally more expensive than ACH transfers.

20. How to Handle a Returned Payment Due to an Incorrect Routing Number?

If a payment is returned due to an incorrect routing number, contact the payer immediately to provide the correct information. You may also need to contact your bank to understand why the payment was returned and what steps need to be taken to resolve the issue. Providing accurate information from the start can prevent these issues.

21. What Are the Common Mistakes People Make When Using Routing Numbers?

Common mistakes include:

- Using the wrong routing number for the type of transaction (e.g., using an ACH routing number for a wire transfer).

- Entering the routing number incorrectly.

- Using an outdated routing number.

- Confusing the routing number with the account number.

22. How Do Banks Update Routing Numbers?

Banks may update routing numbers when they merge with another bank or change their internal systems. When this happens, the bank will typically notify its customers and provide them with the new routing number. It’s essential to update your information with any payers if your bank changes its routing number.

23. What Role Does the Federal Reserve Play in Routing Numbers?

The Federal Reserve Banks assign and manage routing numbers for financial institutions in the United States. They also use these numbers to process electronic payments and transfers, ensuring the smooth operation of the banking system. The Federal Reserve’s role is critical in maintaining the integrity and efficiency of financial transactions.

24. How to Protect Your Banking Information, Including Routing Numbers?

To protect your banking information:

- Keep your account information secure and do not share it with unauthorized parties.

- Monitor your bank accounts regularly for any suspicious activity.

- Use strong, unique passwords for your online banking accounts.

- Be cautious of phishing emails and scams that attempt to steal your information.

- Report any suspected fraud to your bank immediately.

25. What are the Risks of Sharing Your Routing Number?

Sharing your routing number can expose you to the risk of unauthorized withdrawals or fraudulent transactions. While routing numbers are necessary for legitimate transactions like direct deposit, it’s essential to be cautious about who you share this information with and ensure the recipient is trustworthy.

26. How do Financial Institutions Use Routing Numbers for Security?

Financial institutions use routing numbers as part of their security protocols to verify the legitimacy of transactions. They cross-reference routing numbers with account numbers and other identifying information to prevent fraud and ensure that funds are being transferred correctly. This verification process helps to protect both the bank and its customers.

27. What Should You Do if You Suspect Fraudulent Activity Involving Your Routing Number?

If you suspect fraudulent activity involving your routing number:

- Contact your bank immediately to report the fraud.

- Change your online banking passwords and security questions.

- Monitor your bank accounts and credit reports for any unauthorized activity.

- Consider placing a fraud alert on your credit report.

- File a report with the Federal Trade Commission (FTC).

28. How Can Businesses Use Routing Numbers to Streamline Their Finances?

Businesses can use routing numbers to streamline their finances by:

- Setting up direct deposit for employee payroll.

- Automating payments to suppliers and vendors.

- Consolidating bank accounts and optimizing cash flow.

- Using online banking tools to manage transactions efficiently.

- Reducing the risk of errors and delays in financial transactions.

29. What Are the Benefits of Using ACH Payments for Businesses?

The benefits of using ACH payments for businesses include:

- Lower transaction fees compared to credit card payments.

- Faster processing times than traditional paper checks.

- Improved cash flow management.

- Reduced risk of fraud and errors.

- Increased efficiency and automation of payment processes. According to a study by the National Automated Clearing House Association (NACHA), businesses can save up to 50% on transaction costs by using ACH payments instead of checks.

30. How Do Routing Numbers Relate to Mobile Banking?

Routing numbers are essential for mobile banking, as they are used to facilitate electronic transfers and payments through mobile banking apps. When you use your mobile banking app to pay bills, transfer funds, or set up direct deposit, the routing number ensures that the transaction is processed correctly.

31. What is the Impact of Fintech on the Use of Routing Numbers?

Fintech companies rely heavily on routing numbers to provide innovative financial services, such as online payments, peer-to-peer transfers, and digital banking. These companies use routing numbers to connect to the traditional banking system and facilitate electronic transactions. As fintech continues to grow, the importance of routing numbers in the financial landscape will only increase.

32. How Are Routing Numbers Used in Government Payments?

Government agencies use routing numbers to distribute benefits, tax refunds, and other payments electronically. Direct deposit through ACH is a common method for these payments, ensuring that funds are delivered quickly and securely to recipients. This helps to reduce the risk of fraud and improve the efficiency of government operations.

33. What is the Future of Routing Numbers in the Digital Age?

Despite the rise of new payment technologies, routing numbers remain a fundamental part of the US financial system. While there may be future innovations in payment processing, routing numbers will likely continue to play a critical role in facilitating electronic transactions for many years to come. As technology evolves, the security and efficiency of routing number usage will also continue to improve.

34. How Do Banks Handle Routing Numbers During Mergers and Acquisitions?

When banks merge or are acquired, they often consolidate their routing numbers to simplify their operations. Customers are typically notified in advance of any changes to their routing numbers and provided with instructions on how to update their payment information. The FDIC provides guidance to banks on managing these transitions to ensure minimal disruption to customers.

35. What Are the Legal and Regulatory Requirements for Using Routing Numbers?

The use of routing numbers is governed by various legal and regulatory requirements, including those set forth by the Federal Reserve, the FDIC, and NACHA. These regulations aim to ensure the security and accuracy of electronic transactions and to protect consumers from fraud. Banks must comply with these requirements to maintain their access to the ACH and wire transfer systems.

36. How Can Consumers Ensure They Are Using the Most Up-to-Date Routing Number?

Consumers can ensure they are using the most up-to-date routing number by:

- Checking their bank’s website for the latest information.

- Reviewing their bank statements for the routing number.

- Contacting their bank directly to confirm the routing number.

- Avoiding reliance on outdated sources of information.

37. What Role Do Clearing Houses Play in Routing Number Transactions?

Clearing houses, such as the Automated Clearing House (ACH), play a central role in processing transactions that involve routing numbers. They act as intermediaries between banks, facilitating the exchange of funds and ensuring that payments are settled correctly. Clearing houses also provide security and risk management services to protect the integrity of the payment system.

38. How Do Routing Numbers Impact International Remittances?

While routing numbers are primarily used for domestic transactions, they can indirectly impact international remittances. When sending money from the US to another country, the routing number is used to identify the US bank involved in the transaction, while a SWIFT code is used to identify the foreign bank. The combination of these identifiers ensures that the remittance is processed correctly.

39. What Are the Best Practices for Storing and Transmitting Routing Numbers?

Best practices for storing and transmitting routing numbers include:

- Encrypting sensitive data to prevent unauthorized access.

- Using secure communication channels to transmit routing numbers.

- Limiting access to routing numbers to authorized personnel only.

- Regularly reviewing and updating security protocols.

- Complying with data security standards, such as PCI DSS.

40. How Do Routing Numbers Facilitate Interbank Communication?

Routing numbers facilitate interbank communication by providing a standardized way for banks to identify each other and exchange payment information. This allows banks to process transactions efficiently and accurately, ensuring that funds are transferred correctly between accounts. The use of routing numbers promotes interoperability and cooperation within the banking industry.

41. What are the Different Types of Routing Numbers?

There are two main types of routing numbers:

- ACH Routing Numbers: Used for electronic transfers, such as direct deposits and online bill payments.

- Wire Transfer Routing Numbers: Used for wire transfers, which are typically faster and more expensive than ACH transfers.

Some banks may use the same routing number for both types of transactions, while others may use different numbers.

42. How Can Routing Numbers Be Used to Improve Financial Planning?

Routing numbers can be used to improve financial planning by:

- Automating savings and investment contributions.

- Setting up automatic bill payments to avoid late fees.

- Tracking income and expenses through online banking tools.

- Consolidating bank accounts and streamlining financial management.

43. What Resources are Available for Learning More About Routing Numbers?

Resources for learning more about routing numbers include:

- Bank websites and customer service departments.

- The Federal Reserve’s website.

- The FDIC’s website.

- Financial education websites and resources.

- Books and articles on banking and finance.

44. How Do Routing Numbers Differ in Various Regions of the United States?

Routing numbers can vary by region in the United States, as some banks operate in multiple states and may have different routing numbers for each region. It’s essential to use the correct routing number for the specific bank branch or region where the account was opened. Banks typically provide this information on their websites or customer service channels.

45. How Do Technology Companies Utilize Routing Numbers?

Technology companies utilize routing numbers in various ways, including:

- Processing online payments for e-commerce transactions.

- Facilitating peer-to-peer transfers through mobile apps.

- Providing digital banking services, such as online account management and bill payment.

- Integrating with accounting software for automated financial reporting.

46. What is the Process for Obtaining a Routing Number for a New Bank?

The process for obtaining a routing number for a new bank involves applying to the American Bankers Association (ABA) and the Federal Reserve. The ABA assigns routing numbers, while the Federal Reserve manages the routing number system and ensures its integrity. New banks must meet certain requirements and undergo a review process before being assigned a routing number.

47. How Are Routing Numbers Used in Check Processing?

Routing numbers are used in check processing to identify the bank on which the check is drawn. When a check is deposited or cashed, the routing number is read by automated systems to route the check to the correct bank for payment. This process helps to ensure that checks are processed efficiently and accurately.

48. What are the Benefits of Centralized Routing Number Systems?

The benefits of centralized routing number systems include:

- Improved efficiency and accuracy of payment processing.

- Reduced risk of fraud and errors.

- Enhanced interoperability between banks.

- Better regulatory oversight and compliance.

- Greater stability and security of the financial system.

49. How Do Regulatory Changes Affect Routing Number Usage?

Regulatory changes can affect routing number usage by:

- Requiring banks to update their routing numbers or security protocols.

- Changing the rules for electronic payments and transfers.

- Increasing regulatory oversight of the routing number system.

- Promoting greater transparency and accountability in financial transactions.

50. How Does the Use of Routing Numbers Contribute to Financial Stability?

The use of routing numbers contributes to financial stability by:

- Providing a standardized system for identifying and routing payments between banks.

- Facilitating efficient and accurate processing of financial transactions.

- Reducing the risk of errors and fraud.

- Supporting the smooth operation of the banking system.

- Promoting confidence in the safety and security of financial transactions.

These comprehensive questions and answers about routing numbers provide a thorough understanding of their importance and functionality within the financial system.

At CAR-DIAGNOSTIC-TOOL.EDU.VN, we understand that automotive professionals require accurate and reliable information to perform their jobs effectively. While we specialize in providing top-notch diagnostic tools, detailed repair guides, and expert remote support for vehicle maintenance, we also recognize the importance of understanding broader business and financial concepts. That’s why we offer insights into areas like financial transactions, helping you manage your business operations more efficiently.

Eastman Credit Union routing number on a cheque

Eastman Credit Union routing number on a cheque

Our commitment is to equip you with the knowledge and tools you need to succeed in the automotive industry. From understanding complex vehicle diagnostics to navigating the intricacies of financial transactions, CAR-DIAGNOSTIC-TOOL.EDU.VN is your trusted partner.

How CAR-DIAGNOSTIC-TOOL.EDU.VN Can Help You

At CAR-DIAGNOSTIC-TOOL.EDU.VN, we are committed to providing automotive technicians and garage owners with the best diagnostic tools, repair guides, and training programs to enhance their skills and efficiency. Here’s how we can help you excel in your profession:

1. Comprehensive Diagnostic Tools

Our range of diagnostic tools covers all your needs, from basic code readers to advanced diagnostic systems. These tools help you quickly identify issues, reduce diagnostic time, and improve the accuracy of your repairs. According to a study by the National Institute for Automotive Service Excellence (ASE), using advanced diagnostic tools can reduce diagnostic time by up to 40%.

2. Detailed Repair Guides

We offer step-by-step repair guides that provide clear instructions and diagrams, making complex repairs easier to manage. Our guides cover a wide range of vehicle makes and models, ensuring you have the information you need at your fingertips. These guides are invaluable for both novice and experienced technicians, helping to reduce errors and improve repair quality.

3. Remote Support

Our remote support services connect you with experienced technicians who can provide real-time assistance with challenging diagnostic and repair issues. This support is available via phone, video conference, and remote access to your diagnostic tools, ensuring you have the help you need when you need it. Remote support can be a game-changer for complex issues, saving you time and preventing costly mistakes.

4. Technician Training Programs

We offer comprehensive training programs designed to keep you up-to-date with the latest automotive technologies and repair techniques. Our courses cover everything from basic automotive systems to advanced diagnostics and repair, ensuring you have the skills to handle any job. Training programs are essential for staying competitive in the rapidly evolving automotive industry.

5. ECU Programming and Routing

Our ECU programming services ensure your vehicle’s computer system is up-to-date and functioning correctly. We provide routing services for ECUs, ensuring seamless integration and optimal performance. Proper ECU programming is crucial for maintaining vehicle efficiency and performance, and our services are designed to meet the highest standards.

Benefits of Choosing CAR-DIAGNOSTIC-TOOL.EDU.VN

- Increased Efficiency: Our tools and resources help you diagnose and repair vehicles faster, reducing downtime and increasing your shop’s throughput.

- Improved Accuracy: Our detailed repair guides and remote support services help you avoid errors and ensure high-quality repairs.

- Enhanced Skills: Our training programs keep you up-to-date with the latest technologies, improving your skills and making you more valuable to your customers.

- Better Customer Satisfaction: By providing faster, more accurate, and more reliable service, you can improve customer satisfaction and build a loyal customer base.

- Increased Profitability: Our solutions help you reduce costs, increase revenue, and improve your shop’s overall profitability.

Success Stories

- John’s Garage, Los Angeles: “CAR-DIAGNOSTIC-TOOL.EDU.VN has transformed our business. The diagnostic tools are top-notch, and the remote support has saved us countless hours on difficult repairs.”

- Maria’s Auto Repair, Houston: “The training programs are excellent. I’ve learned so much about new technologies, and my repair quality has improved significantly.”

- Tom’s Automotive, Miami: “The detailed repair guides are a lifesaver. They’ve helped me tackle jobs I wouldn’t have attempted before.”

Take the Next Step

Ready to take your automotive skills and business to the next level? Contact us today to learn more about our diagnostic tools, repair guides, remote support services, and training programs.

- Address: 1100 Congress Ave, Austin, TX 78701, United States

- WhatsApp: +1 (641) 206-8880

- Website: CAR-DIAGNOSTIC-TOOL.EDU.VN

Let CAR-DIAGNOSTIC-TOOL.EDU.VN be your partner in success. We’re here to provide you with the tools, resources, and support you need to excel in the automotive industry. Contact us today and see how we can help you achieve your goals.

Addressing the Challenges of Automotive Technicians

We understand the challenges you face as automotive technicians. The job is physically demanding, often requiring long hours in uncomfortable conditions. You’re constantly exposed to grease, oil, and chemicals, and you need to stay updated with the latest automotive technologies to remain competitive. According to a report by the Bureau of Labor Statistics, the automotive industry is projected to grow by 5% over the next decade, creating even more demand for skilled technicians.

Common Challenges Include:

- Physical Strain: The job requires a lot of physical labor, which can lead to fatigue and injuries.

- Exposure to Hazardous Materials: Technicians are often exposed to harmful chemicals and materials.

- Keeping Up with Technology: The automotive industry is constantly evolving, with new technologies being introduced regularly.

- Time Pressure: Technicians often work under tight deadlines to get vehicles back on the road as quickly as possible.

- Competition: The automotive repair industry is competitive, and it can be challenging to attract and retain customers.

CAR-DIAGNOSTIC-TOOL.EDU.VN is here to help you overcome these challenges by providing the tools, resources, and support you need to succeed. Our diagnostic tools help you quickly identify issues, our repair guides provide clear instructions, our remote support offers real-time assistance, and our training programs keep you up-to-date with the latest technologies.

How Our Services Address Your Needs

Our services are designed to address the specific needs of automotive technicians, helping you work more efficiently, accurately, and safely. Here’s how we can help:

- Efficiency: Our diagnostic tools and repair guides help you diagnose and repair vehicles faster, reducing downtime and increasing your shop’s throughput.

- Accuracy: Our detailed repair guides and remote support services help you avoid errors and ensure high-quality repairs.

- Safety: We provide information and resources to help you work safely, reducing your risk of injuries and exposure to hazardous materials.

- Knowledge: Our training programs keep you up-to-date with the latest technologies, improving your skills and making you more valuable to your customers.

- Support: Our remote support services connect you with experienced technicians who can provide real-time assistance with challenging diagnostic and repair issues.

At CAR-DIAGNOSTIC-TOOL.EDU.VN, we’re committed to helping you succeed in the automotive industry. Contact us today to learn more about how our services can benefit you.

FAQ: ECU Routing Number and Automotive Diagnostics

1. What is an ECU, and why is it important?

An ECU (Electronic Control Unit) is a computer that controls various systems in a vehicle, such as the engine, transmission, and brakes. It is essential for optimizing performance, efficiency, and safety.

2. How do diagnostic tools help in identifying ECU-related issues?

Diagnostic tools read error codes from the ECU, providing technicians with insights into potential problems. This helps streamline the diagnostic process and reduces guesswork.

3. Can CAR-DIAGNOSTIC-TOOL.EDU.VN’s remote support assist with ECU diagnostics?

Yes, our remote support team can provide real-time assistance in diagnosing ECU-related issues, guiding you through the troubleshooting process.

4. What kind of training does CAR-DIAGNOSTIC-TOOL.EDU.VN offer for ECU programming?

We offer comprehensive training programs that cover ECU programming, flashing, and calibration, ensuring you stay updated with the latest techniques.

5. Are the repair guides provided by CAR-DIAGNOSTIC-TOOL.EDU.VN helpful for ECU repairs?

Yes, our detailed repair guides provide step-by-step instructions for ECU repairs, making complex tasks more manageable.

6. How can I update my ECU software using CAR-DIAGNOSTIC-TOOL.EDU.VN’s tools?

Our tools support ECU software updates, allowing you to keep your vehicle’s computer system current and functioning correctly.

7. What is ECU routing, and why is it necessary?

ECU routing ensures seamless integration between different ECUs in a vehicle, optimizing communication and performance.

8. How can I troubleshoot common ECU problems with CAR-DIAGNOSTIC-TOOL.EDU.VN’s resources?

We provide resources that help you troubleshoot common ECU problems, including diagnostic codes, repair tips, and expert support.

9. Does CAR-DIAGNOSTIC-TOOL.EDU.VN offer support for all types of ECUs?

Our tools and resources support a wide range of ECU types, ensuring compatibility with various vehicle makes and models.

10. How can training from CAR-DIAGNOSTIC-TOOL.EDU.VN enhance my diagnostic skills?

Our training programs provide hands-on experience and expert guidance, helping you master diagnostic techniques and improve your overall skills.

AIDA: Attract, Interest, Desire, Action

Attention

Are you an automotive technician struggling with complex diagnostics and repairs? Do you want to enhance your skills and improve your shop’s efficiency?

Interest

CAR-DIAGNOSTIC-TOOL.EDU.VN offers top-notch diagnostic tools, detailed repair guides, expert remote support, and comprehensive training programs to help you excel in the automotive industry.

Desire

Imagine diagnosing and repairing vehicles faster, avoiding costly errors, and staying up-to-date with the latest technologies. Our solutions can transform your business and improve customer satisfaction.

Action

Contact us today to learn more about how CAR-DIAGNOSTIC-TOOL.EDU.VN can help you achieve your goals.

- Address: 1100 Congress Ave, Austin, TX 78701, United States

- WhatsApp: +1 (641) 206-8880

- Website: CAR-DIAGNOSTIC-TOOL.EDU.VN

Don’t miss this opportunity to take your automotive skills and business to the next level. Contact us now and see how we can help you succeed.